Climate Series: Oil and gas preparing for a carbon-constrained world – leaders and laggards

The investor pressure on oil and gas companies to address climate change as seen in the latest proxy voting season has mounted like never before. In May, BP shareholders, representing over 99% of the votes, passed a resolution asking the company to align its business strategy and investments with the Paris Agreement. When a similar resolution was blocked by Exxon, who had asked the U.S. Securities and Exchange Commission to reject it, investors urged a vote to split the chief executive officer and board chairman roles as protest.

These are only examples of investors’ deep concern for the traditional oil and gas business, which would need to undergo a fundamental change to become a general energy company that did not based their operations on fossil fuels in the decade to come. As seen from our three-year engagement with the oil and gas majors, some of them are clearly taking steps to transition to a lower-carbon economy and having a climate roadmap in place. Yet some others have not really changed the course yet, continuing with the ‘business as usual’ approach. The viability of their business model will be in question when climate regulations and carbon prices further strengthen.

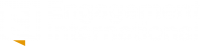

The energy transition planning, underpinned by clear strategies and targets in line with the two-degree trajectory has been among the focus areas of our direct engagement dialogues conducted on behalf of the institutional investors. Since 2016, we have engaged with 22 of the Top100CCC oil and gas companies, including three companies involved in high-impact oil sands.

Dealing with the dual challenge

Throughout our engagement with oil and gas companies, it is apparent that most of them recognise the role they play in addressing the dual challenge of reducing GHG emissions on one hand and meeting the rising energy demand on the other. Nearly 70% of the engaged companies have considered such climate-linked risks and opportunities. The more progressive ones – around 30% of the companies – try to model the climate impacts on their operations, strategy and financial planning by using scenario analysis, as recommended by the Task Force on Climate-related Financial Disclosures (TCFD). However, similar to other sectors like utilities and mining, an approximate 20% do not consider various climate scenarios to assess the resilience of their business.

While carbon-related regulations are identified by most as a potential risk, it is widely viewed that oil and gas will remain an important part of the energy mix even in a lower-carbon world. Many of the engaged companies still anticipate an increase in oil and gas production and investments, which will continue to be a major component of their business.

Positioning for a lower-carbon future

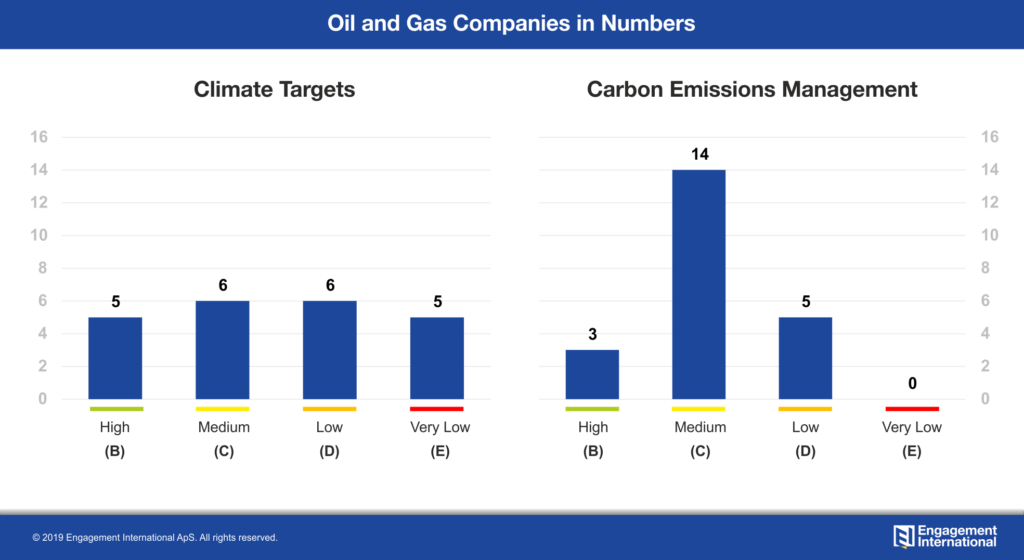

Although the oil and gas companies increasingly recognise the impact of climate change on their business, most of them do not adequately factor in those considerations at a strategic level. Merely 15% of the engaged companies demonstrate a High level of Climate Management underpinned by a climate strategy that set a pathway to around 2030–2035. Equinor, Eni, Royal Dutch Shell and Total are the more progressive ones on this front. But around half of the engaged companies, which indicate a Moderate level of efforts, would need to provide more clarity on their climate strategy.

As shown in the figure below, only 23% of the companies have set more ambitious climate targets to drive their strategies. Still, however, there is a long way to go to encourage the companies to commit to carbon emissions reductions from both operations and products. Only Shell and Total have announced the ambitions to reduce their carbon footprint by integrating scope 1, 2 and 3 carbon emissions in a kind of energy lifecycle perspective. The others repeatedly refrain from setting such targets explaining that the emissions related to their customers (scope 3) are beyond the control of the company. At the same time, a fifth of the companies has insignificant targets in terms of their aggressiveness or does not have targets at all.

When it comes to the carbon emissions management, one of the key elements of the companies’ strategic efforts is a shift from oil to natural gas. This strategy is pursued by nearly 65% of companies. As highlighted during our engagement dialogues, natural gas is considered as a mid-term solution and as a tool to contribute the most in reaching the current carbon emissions targets. In the longer-term, natural gas is also viewed by some companies as a back-up for renewable energy in electricity generation. To this end, the companies – individually or as an industry effort – have recently intensified actions to address methane emissions from natural gas, which has a higher global warming potential when released to the atmosphere than carbon dioxide.

Other important carbon reduction strategies are: development of carbon capturing, storage and utilisation technology (77% of companies); investments in renewables and biofuels (99% of companies); as well as and energy efficiency measures, usually on both the production and consumer sides. Also, there is a growing number of companies (27%) that are more actively moving to new business areas such as development of low-carbon electricity generation business. Apart from that, some of the companies have recently included in their strategies nature-based solutions (e.g. reforestation) to be developed on a large-scale in the coming years. Finally, it can be seen that the companies have been adjusting their assets portfolio over time e.g. divestments from high carbon impact and high cost assets (like Shell and Total).

More action needed

It can be noted, that around 20% of the companies have demonstrated a positive Engagement Progress. Their preparations for a lower-carbon economy will give them a potential competitive advantage over others in a carbon-constrained world.

Nevertheless, the positive efforts have yet to be reflected on the performance side. Only two companies have so far been rated ‘High’ on the Performance milestone considering their climate exposure and carbon emission performance as key indicators, among others. More than half of the companies have been assessed to having Medium level of performance. Low or Very Low performance level has been registered for nearly 40% of companies.

The most sluggish progress on performance can be observed among the companies involved in the oil sands activities, such as Imperial Oil, Suncor Energy and Canadian Natural Resources. Their carbon emission intensities normalised by production are three-times higher than the industry average, although they show a relatively good management level.

Overall, the sector shows signs of progress on various fronts driven by policies and regulations, technology, and investor pressure, but still there are many gaps that need to be addressed to speed up the transition process. Companies with a ‘business as usual’ approach need to catch up with those that are more active in positioning themselves for a lower-carbon future. After all, the climate change challenge is not an issue any oil and gas company can afford to ignore.

This blog is part of the climate series, where we present the latest engagement results from the “Top 100 Climate Change Contributors” engagement project.