Climate Series: Facing the Dilemma with Coal Divestments

Still more institutional investors are divesting from coal companies to protect their investments against stranded assets. It is understandable, because most coal companies are not aligned with the well below two-degree goal. However, it raises a dilemma, because the reduced investor owners’ pressure on the coal majors due to divestment can make it more difficult to reach the Paris Agreement. This third blog in our climate series presents the results of Engagement International’s engagement with coal companies over the past three years, which can further inform investors’ strategies to the controversial industry.

While the world is struggling to reach the 1.5 – 2°C trajectory, the largest producers and users of coal continue to have larger influence on climate change than any other companies in the world. In total, the 30 largest owners of coal reserves control more than 200 gigaton of CO2 or more than half of the potential future CO2 emissions from all fossil fuel reserves, owned by publicly listed companies.

Over the recent years, a number of investors have committed themselves to reduce their fossil fuels exposure, typically by divesting from companies, which derive more than 30% of their revenues from thermal coal or have a coal-based energy mix that exceeds 30%. Nevertheless, the coal divestment movement does not seem to diminish coal’s key role to climate change challenge, as it continues to be the largest source of electricity and the second-largest source of primary energy. According to International Energy Agency (Global Energy & CO2 Status Report, March 2019), coal-fired power generation accounts for 30% of all energy-related carbon dioxide emissions.

This means that, if we are to reach the goals of the Paris Agreement, the world needs to convince these thermal coal majors, such as Coal India, Peabody and China Coal, that most of their coal reserves should remain in the ground, to enable changes to their business strategies and models that fit the low carbon world. Given the scale of their negative climate change impacts, if coal companies are not acting responsibly, other positive efforts in support of the Paris Agreement can very likely become futile.

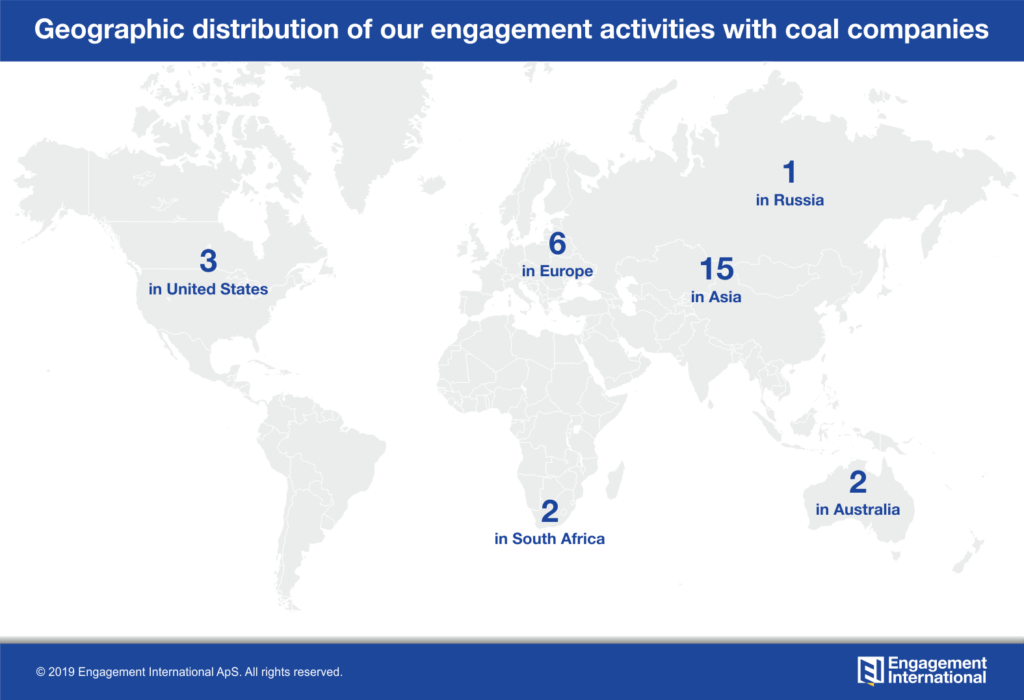

Therefore, since the adoption of the Paris Agreement in December 2015, Engagement International has been engaging with about 30 publicly listed owners of the largest coal reserves identified in the MSCI ASWI IMI Index as part of the Top 100 Climate Change Contributors (Top100CCC) project (see figure below). Most of the companies are classified as coal miners, diversified miners and producers of electric power, steel and cement.

Without doubt there is an urgent need for investors who own these coal companies to act, and get insights from engagement that can improve their approach to coal-related and climate investments. As seen in our engagement with the Top100CCC every six months for the past three years though, just a few coal companies have demonstrated engagement progress.

Poor management level but increasing recognition of climate risks

As part of our bi-annual engagement process, EI actively engages with 17 of the identified coal reserves companies, which are present in our investor clients’ portfolio. 14 of the companies demonstrate a very high or high climate risk exposure, due to more than 30% of thermal coal in their reserves or energy mix. A handful of the companies is considered as less controversial, as they are focused on metallurgical coal, primarily used in steel production, where it is difficult to find substitutes.

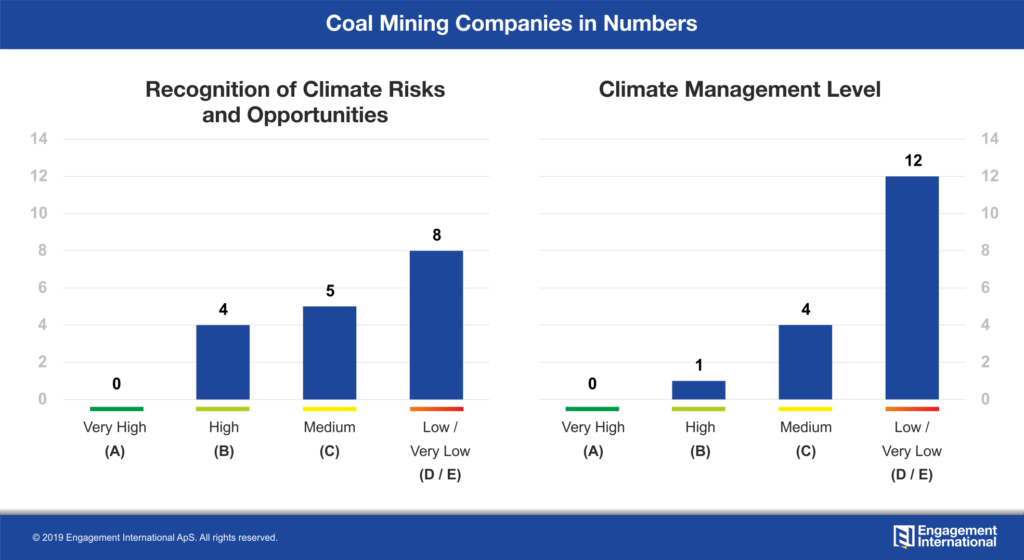

Overall, the coal companies demonstrate an increasing recognition of climate as a significant issue for its business with about half of the engaged companies clearly articulating their climate related-risks and business opportunities (see figure below). This can be considered as the very starting point of managing climate issues in a responsible way. Yet, our engagement shows that only a few of them, such as BHP, Anglo American, South32 and Glencore have progressed with concrete commitments and measures being undertaken despite their severe climate challenges.

Over the course of the engagement process, the most meaningful engagement progress has been registered for seven companies which demonstrated clear commitment to the Paris Climate Agreement and the well below two-degree-goal. These companies are mostly leading in terms of carbon reduction targets and strategies, often driven by the long-term ambition to operate what they call carbon-neutral mines in the future. Yet, only five coal mining companies show moderate to high Climate Management Level, with the remaining ones significantly lagging behind the peer group (see figure above).

Likewise, less than a third of the companies are assessing the resilience of their business model and business operations to a range of future low-carbon scenarios, including the two-degree scenario, as recommended by the TCFD (Task Force on Climate-related Financial Disclosures). Similar to the electric utilities sector, disclosure of financial efforts related to low-carbon solutions and financial impacts on the company’s business in the analysed climate scenarios is rather limited.

In terms of carbon emissions reduction measures, all of the companies with whom we engaged are focusing on energy efficiency. Most of them are involved in renewables to a low or medium degree, while half of the companies apply carbon capturing and storage to some degree. It is expected that the focus on renewables will further increase, as ensuring access to renewable energy is considered to be a key part of decarbonisation plans in the sector. Despite signs of progress in carbon emissions management, improvements in performance are yet to be seen as 80% of the companies show low or very low level of efforts in that respect.

Last but not least, climate governance is an important topic on our agenda for climate engagements. Although nearly all companies have board oversight of climate issues to some degree, only half of them link climate targets and metrics with executive remuneration and a fourth ensure transparency over climate-related lobbying to some extent. The BHP’s Industry Association Review, published at the end of 2017, has become a best-practice example in this regard. Meanwhile, investors continue to call for greater transparency and robust governance procedures related to corporate lobbying on climate change as seen in the recently published IIGCC Investor Expectations on Corporate Climate Lobbying.

Exploring long-term opportunities

The most advanced coal companies do not consider thermal coal as a long-term business asset and are therefore reducing or selling off. As an example, South32 is in a divestment process to sell its South African Energy Coal operations. The industry has also seen a strengthened commitment to the transition to a low-carbon economy from Glencore. As recently as February 2019, the company announced its decision to cap coal production at current levels in response to investor engagement efforts. It is among EI’s recommendations for coal companies that they should clarify targets and strategies for playing a responsible role in fulfilling the well-below two-degree goal of the Paris Agreement.

By shifting the focus to climate-related opportunities, some coal companies are already positioning themselves for a low-carbon economy. These are looking more into adjusting their portfolios to expand investments in commodities such as iron ore, copper, zinc and nickel that are essential to the low-carbon transition of other industries, e.g. for batteries in energy storage and electric vehicles.

Investment case in (mis)alignment with the Paris goals

EI’s climate engagement model bases on 10 climate milestones aligned with the TCFD recommendations. For the coal companies we specifically stress the importance of 1) clear carbon reduction targets; 2) commitment to cease or reduce new investments in coal sites; 3) developing carbon capturing and storage solutions; and as many of the coal companies are also producers of electricity, cement or steel, we recommend them to 4) present a clear plan of switching from their own coal-fired plants to lower-impact energy sources or preferably renewables.

Despite the gradually increasing recognition of the climate risks and opportunities, most of the major coal companies’ preparedness to manage these appears to be rather low. Currently, more than 80% of the companies are flagged with a ‘negative’ Climate Investment Signal due to inadequate levels of engagement progress and climate management efforts despite the significant climate risk exposure they are faced with. However, there is a handful of coal companies which are more proactively addressing climate change. These findings, which can potentially present more perspectives to responsible investors, cannot be easily discovered by those who are divesting based on a percentage rule. Divestment may seem like a straightforward solution, but it alone does not reduce the complexity and dilemmas investors are faced with.

With our engagement findings, investor clients can identify which companies are not aligned with the Paris Agreement and consider divestment as a strategy to reduce risks. At the same time, we will continue our engagement process on their behalf with the high-impact coal companies, seeking to influence them to transition to a two-degree-compliant economy and accelerate further emissions cuts. Once the most progressive companies are on the right track, our Climate Investment Signal will indicate that they again can be considered as a potential part of the investment portfolio.

This blog by Marta Górska and Erik Alhøj, is part of the climate series, where we present the latest engagement results from the “Top 100 Climate Change Contributors” engagement project.