Climate Series: Electric Utilities Adapting to a Low-carbon Future

Electric utilities are among the biggest climate change contributors. Globally the sector is responsible for 25% of CO2 emissions, mainly due to its significant reliance on fossil fuels for energy generation.

Engagement International has been conducting regular, direct climate engagements with electric utility companies worldwide, since the adoption of the Paris Agreement in December 2015. Through in-person meetings and conference calls every six months over the past three years we have been seeking to influence these companies to transition to a two-degree-compliant economy and propel further emissions cuts, on behalf of our institutional investor clients. Out of the Top 100 Climate Change Contributors that we have identified in the MSCI ACWI IMI Index, 39 companies were electric power producers. Currently we are engaging with 30 of such electric utilities, where the majority of cases are selected for having the highest current scope 1 and 2 CO2 emissions. Seven companies were from Europe, nine from the US, 13 from Asia and one from Australia.

Accelerating decarbonisation of energy mix

Today, approximately 37% of electricity globally comes from burning coal, which emits a staggering amount of CO2. However, over the recent years, reliance on coal for energy generation has been falling thanks to more stringent emission regulations and pricing shifts that improved the economics of cleaner energy sources like natural gas and renewables. This trend has been particularly visible in Europe, where several countries have announced national plans to partially or fully phase out coal by 2030 or earlier. Coal retirements are also making a headway in pushing forward the decarbonisation of the US power sector, despite the country’s withdrawal from the Paris Agreement.

Against this backdrop, a third of the engaged utilities companies have reduced the proportion of coal-fired generation relative to their total electricity output below the 30% mark. Our engagement dialogues also show that there is an increasing recognition among companies that the use of coal for energy generation would have to be reduced and ultimately discontinued. However, we also note that the progress on this front has been rather sluggish in developing economies, where coal remains a dominant fuel. That is why the role of coal in the companies’ energy mix in the mid- and long term continues to be an important topic on our agenda for climate engagements.

In parallel to the gradual phase-out of aging coal-fired generating capacity, investments in renewable energy assets have been another frequently discussed carbon emissions reduction strategy in our engagement dialogues. 40% of engaged companies exhibits a high or very high level of efforts when it comes to the use of renewables. Many has also set targets to further increase the renewable capacity. At the same time, the leaders of the energy transition have been venturing into new business areas such as smart electricity solutions (E.g. Enel S.p.A and Engie) and energy storage solutions (E.g. AES Corporation) to support their low-carbon energy model and capitalise on digital opportunities.

Strengthening approach to carbon emissions management

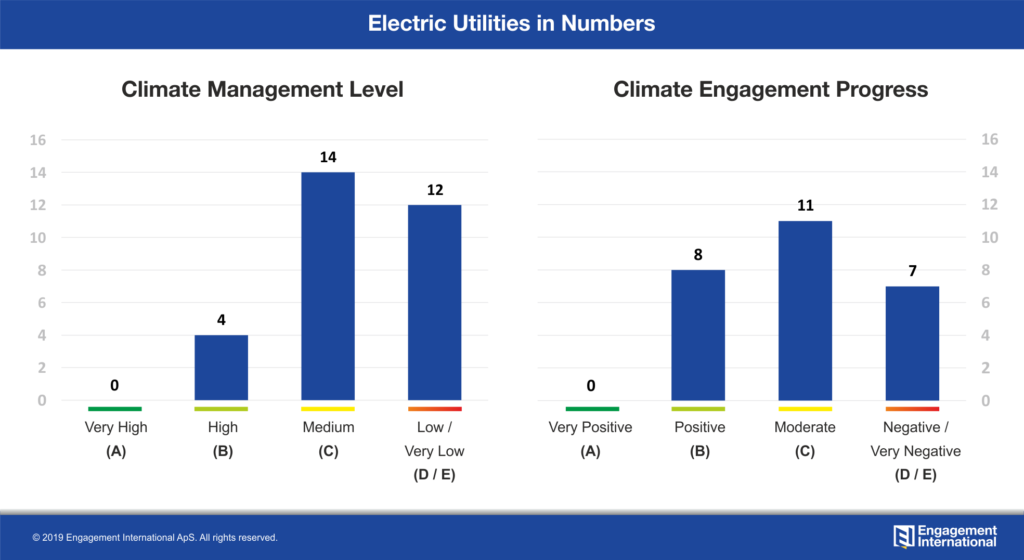

Growing pressure for carbon emissions cuts has also led the companies to set more and more aggressive targets for carbon emissions reduction. Over 70% of the companies with whom we engage has a clear carbon emissions management strategy bolstered by a quantitative emissions reduction target. Of those, five companies consider the target to be aligned with the objective of limiting global warming to 2°C above pre-industrial levels. However, only two (Enel S.p.A and NRG Energy) have certified it as science-based by an independent organisation, like the Science Based Targets initiative (SBTi). Overall, we assess that four companies have attained a high level of climate management, while 14 are considered to have moderate level of efforts (see figure below).

Note: Four companies whose engagement process has just initiated will receive their Engagement Progress ratings after the next dialogue is completed.

Increasing focus on climate-related risk, but financial integration still poses challenges

The majority of electric utilities (70%) has identified its most material climate-related risks and opportunities, putting in place specific action plans to mitigate their impact and ensuring adequate management. A similar percentage also proactively evaluates how investment decisions today will impact their carbon profile in the future, using internal carbon shadow prices and scenario analysis. However, only a handful of the engaged companies have assessed the resilience of its strategy and operations in different climate scenarios, including the two-degree scenario, in line with the TCFD (Task Force on Climate-related Financial Disclosures) recommendations. Our dialogues uncover, that climate scenario analysis remains the biggest challenge for the companies due to the complexity of the subject matter and the fact that industry in general is still gaining experience, as well as the lack of clear guidelines on how the TCFD recommendations should be implemented. Therefore, integration of related results into mainstream financial disclosures will likely require some time and collaborative industry effort before it will become more widely adopted.

Engagement as an investor tool to spur positive change

Across the board, while the positive momentum continues to build, it remains to be seen whether the sector’s strengthening carbon emissions management efforts will bring about results quickly enough to meet the goals laid out in the Paris Agreement. Eight out of the 30 engaged companies register a ‘positive’ engagement progress (see figure above). However, 15 are flagged with ‘negative’ investment signal due to inadequate levels of engagement progress and climate management efforts despite the significant climate risk exposure they are faced with.

Engagement can help to bridge that gap and it is particularly relevant for investors who seek to align their investment strategies with low-carbon objectives and manage climate-related risks. The benefit is twofold. First, it allows for deeper understanding of portfolio companies with significant carbon emissions. Second, engaging with electric utilities offers a unique opportunity to spur positive change, as it is relatively easier for the industry to adapt its business model to utilising low- or zero carbon emitting energy sources. Such opportunities might not be immediately available in other types of energy or carbon-intensive companies that are more reliant on fossil fuels.

This blog is part of the climate series, where we present the latest engagement results from the “Top 100 Climate Change Contributors” engagement project.