Climate Series: Engaging with the Top 100 Climate Change Contributors

On behalf of institutional investor clients, Engagement International has evaluated and engaged with the 100 listed companies that contribute the most to climate change since the Paris Agreement was adopted in December 2015. Through in-person meetings and conference calls every six months over the past three years, we seek to encourage the companies to align their business with the well-below two-degree goal. This blog is the first of a climate series, in which we will discuss the premise and results of the engagement project “Top 100 Climate Change Contributors” (Top100CCC).

In many surveys the fight against climate change has topped the list of concerns among consumers, voters and institutional investors around the world. So, what can be done to slow down global warming and keeping it in check?

To answer this, many individuals have heeded the call to adopt a climate-friendly lifestyle by, for example, eating less beef and avoiding air travels. While this can reduce one’s personal carbon footprint to some degree, it is obvious that systemic changes are necessary given the scale of the problem we are faced with. Politicians are attempting to effect such changes through policies and regulations. The idea is to discourage the use of fossil fuels and incentivise the development of cleaner and renewable energy, e.g. through different forms of carbon pricing and subsidies for renewables. Yet, policymaking is a slow process and sometimes regulations that benefit the climate might not be passed due to opposition from different interest groups. In other cases, the effectiveness of certain policy tools like the EU’s carbon emissions trading scheme remain uncertain.

It is clear, that consumer and political powers that seek to systemically address climate change are not faced without challenges. This leaves the main responsibility of driving for the necessary changes to the largest corporate producers and users of fossil fuels, and not least their institutional investors. Institutional investors can as owners encourage these companies, whose business is heavily dependent on fossil fuels, to move from a carbon-based production to one that utilises cleaner and renewable energy sources in a low-carbon future.

Engagement as an investor response to climate change

Professional institutional investors like pension funds, banks, municipalities and cities etc. are responding to climate change with various strategies. Common ones are impact investing in climate solutions, investing in equity indexes that cover climate-friendly companies, providing funds to companies through green bonds and divesting from high carbon-emitting companies.

However, among the different approaches we believe, that the most direct and impactful one that institutional investors can immediately act on is exercising their active ownership, also known as engagement. It can be conducted through company dialogues, voting on climate-related shareholder resolutions at general assemblies or a combination of both. The goal is to influence the portfolio companies that are most exposed to climate risks and opportunities to adequately and responsibly manage these issues.

Engaging with the 100 most-climate-exposed companies

A significant example of climate-focused engagement initiatives is the “Climate Action 100+” launched in December 2017, where a network of institutional investors coordinated in groups, engage with more than 100 listed companies they have assessed to have the largest impact on global warming.

Independently of this initiative, we at Engagement International have implemented a similar engagement project in collaboration with institutional investor clients right after the Paris Agreement was adopted in December 2015. Our objective, like that of Climate Action 100+, is to influence the 100 listed companies in the MSCI ACWI IMI Index, that are the largest Climate Change Contributors (“Top100CCC”) to align their business strategies and models with the well-below two-degree goal. The lists of engaged companies of the two projects are indeed quite similar to each other.

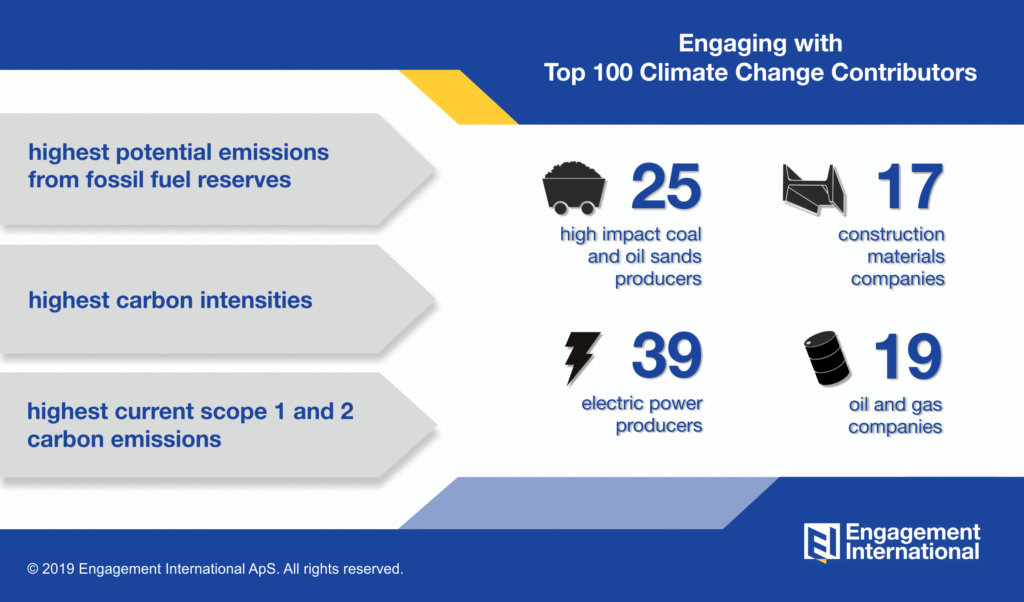

The Top100CCC are identified based on the data from MSCI ESG Research. These companies have 1) the highest potential emissions from fossil fuel reserves, 2) the highest current scope 1 and 2 carbon emissions, and 3) the highest carbon intensities. They collectively represent 80% of fossil fuel reserves owned and nearly half of the Scope 1 and 2 carbon emissions by all listed companies (ignoring some degree of double counting).

As of 2019, the Top100CCC comprises 25 high-impact coal and oil sands producers, 19 oil and gas companies, 39 producers of electric power and 17 construction materials companies producing carbon-intensive cement and steel. 44 of them are from Asia, 21 from Europe, 20 from the US and Canada, nine from Russia and six from other parts of the world including Australia, Africa and Latin America.

Main engagement results

Since 2016 we have been engaging with the Top100CCC every six months through in-person meetings, conference calls or e-mail correspondence, if meetings are not possible. Each engagement dialogue is systematically evaluated following our assessment methodology. Our engagement report to investor clients include various ratings of the companies such as investment signal, climate risk, management level and engagement progression, as well as details of the dialogue and recommendations for improvements. With more than three years of engagement and reporting, we now have a good picture of the companies’ performance and alignment with the TCFD (Task Force on Climate-related Financial Disclosures) recommendations and the Paris Agreement.

Many of the 100 companies have shown a clear commitment to the Paris Agreement and have taken significant steps in the transition towards a low-carbon future. However, more than half of the companies are far from being aligned with the Paris Agreement and will most likely never contribute to the well-below two-degree goal. These are mainly companies that produce high-impact coal and oil sands or uses thermal coal extensively in the production of electric power, steel or cement.

59 of the Top100CCC demonstrate a very high or high climate risk exposure, due to more than 30% of thermal coal or oil sands in their reserves or energy mix. Quite some institutional investors are divesting from these companies, but our engagement shows that a few of them, such as the mining companies BHP, Anglo American and South32 have shown engagement progress despite their climate challenges.

In terms of the management level of climate issues, just 12 of the 100 companies show a high management level, while 55 or more than half of the companies have a low or very low level. Management level aside, an equally important indicator is whether the companies are moving fast enough in the right direction to manage climate issues. In this respect, 17 have a positive Engagement Progression, while 24 show a negative development.

We believe, that positive engagement progress can be associated with the reduction of the financial risk premium investors demand to invest in high-risk companies, which can contribute to creating long-term financial value, with all other things being equal. In cases where negative engagement progress has been continuously recorded, escalated engagement efforts such as proxy voting will be considered.

Throughout the engagement, we measure companies’ engagement progress and the climate management level against 10 climate milestones aligned with the TCFD recommendations. The first milestone is the companies’ recognition of their own most material climate-related risks and opportunities. Just 19 of the 100 companies show a high level of recognition, while nine have no recognition at all. 43 have a commitment to the Paris Agreement to some or a high degree. About the same number have set targets to reduce carbon emissions, while a little more than half of the companies have a clear climate change strategy. Other milestones assessed are carbon emissions management, climate adaptation, climate governance, business- and financial integration, transparency and performance.

In the coming blogs we will further highlight some of the key results of engaging with the Top100CCC by industries.