Climate Series: Decarbonisation of Cement and Steel Sectors

With their widespread use across multiple sectors, from construction and infrastructure to energy and transportation, cement and steel are central to modern economy. They are also inherently energy and carbon-intensive. Taken together, those two sectors account for up to 15% of global CO2 emissions, and as the world’s population grows, emissions are only projected to increase.

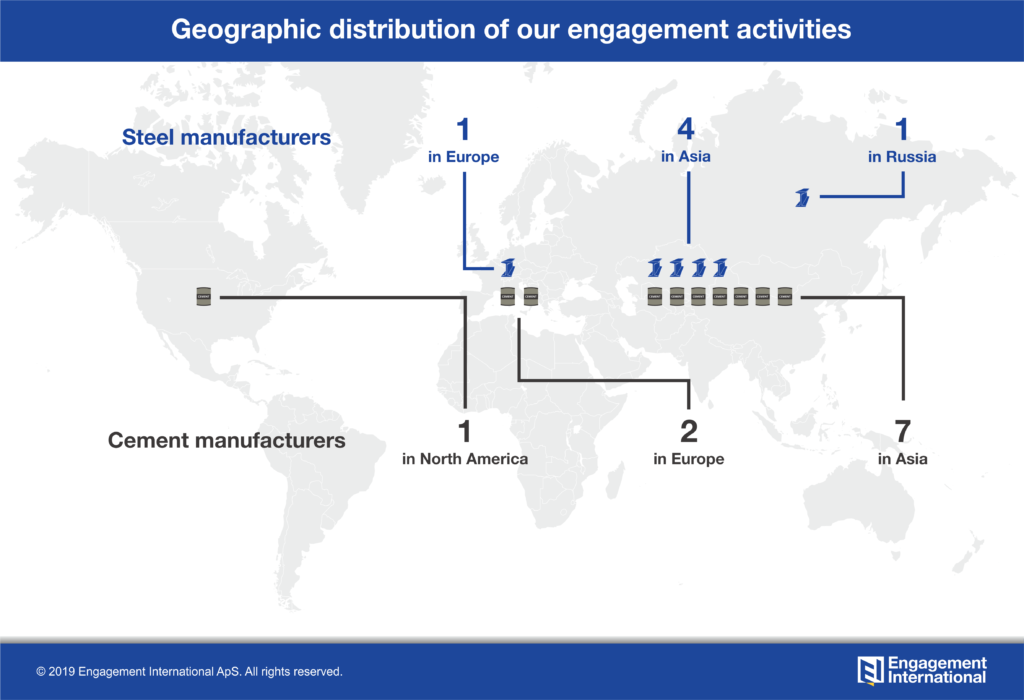

Since the adoption of the Paris Agreement, Engagement International has been seeking to accelerate decarbonisation efforts in cement and steel sector though regular, direct engagement dialogues, on behalf of our institutional investor clients. As part of our “Top 100 Climate Change Contributors” engagement project we have identified 10 cement and six steel companies, and we are currently engaging with all but one of them.

Long road ahead

The majority of the engaged cement and steel producers recognise climate change as a significant issue and consider mitigation of CO2 emissions a necessary precondition to futureproof its business. Yet, merely a third of them set time-bound carbon reduction targets to guide their future carbon management efforts. Furthermore, the analysis by the Transition Pathway Initiative (TPI) suggests that only two of the companies with carbon reduction targets in place (LafargeHolcim and its Indian subsidiary Ambuja Cement) can be considered aligned with a two-degree scenario. However, our engagement shows that there are signs that the companies may be adjusting their level of ambition, which will certainly be a focus of our ongoing engagement. Overall, we assess that three companies have attained a ‘high’ level of climate management, while nine are considered to have ‘moderate’ level of efforts. Generally, performance varies by industry and region, with higher percentage of European companies and higher share of those in the cement industry registering ‘moderate’ or ‘positive’ engagement progress.

Process emissions difficult to abate

Cement and steel sizable carbon footprint partly stems from high fuel requirements, which are mostly satisfied by fossil fuels. However, significant proportion of total CO2 emissions comes from the chemical processes themselves. For instance, the primary chemical reaction during the production of virgin steel is the removal of oxygen from iron ore to obtain raw iron – a process known as iron reduction. Similar reaction (calcination) is involved in the cement production. Both of them result in large amount of carbon dioxide being released as a by-product. Because of these process emissions, decarbonisation of cement and steel sector is particularly challenging. So much so, that without technological innovation and supportive regulatory framework drastic emissions cuts necessary to meet the objectives of the Paris Agreement might be difficult to achieve.

Nevertheless, while technological solutions at a large scale are not yet commercially viable, companies in each sector have been taking intermediary steps to lower their carbon footprint.

Carbon mitigation levers in the cement sector

Improving energy efficiency, increasing the use of alternative fuels, reducing clinker-to-cement ratio and integration of emerging innovative technologies, such as carbon capture and storage are the main carbon mitigation methods available in cement manufacturing. 80% of the engaged cement companies have made these an integral part of their carbon management strategy.

- Clinker is the main ingredient in cement and the amount used is directly proportional to the amount of CO2 generated in the production process. Accordingly, majority of the engaged companies have taken steps to substitute it with alternative raw materials, such as blast furnace slag, fly ash and pozzolans. At the same time, industry leaders have been also developing alternative binding materials that almost completely eliminate the need for conventional clinker.

- Replacing carbon-intensive pet coke and coal with cleaner energy sources, including biomass and waste has been another frequently employed strategy to lower CO2 40% of the engaged cement producers have additionally set targets to increase alternative fuel rate. Nevertheless, our dialogues with the companies have also revealed that there are considerable regional variations when it comes to the availability of alternative fuels, which make the substitution more challenging outside of Europe and the US.

- Carbon capture and storage (CCS) is an important technology to decarbonise the cement sector. Yet, it remains at pilot stage. Only three of the engaged companies have demonstrated more advanced level decarbonisation of efforts, with HeidelbergCement positioning itself as a front-runner.

Innovative steel production routes on the horizon but investments lag behind

On the other hand, in the steel sector, the most commonly used strategy to reduce carbon emissions was energy conservation. All of the engaged companies have been actively implementing various energy efficiency measures, including self-generation of electricity from waste heat and by-product gases. The most advanced companies have been also seeking to commercialise low- and zero-carbon production routes and the use of CCS/CCU technologies. For example, with the potential to eliminate virtually all carbon emissions from the ironmaking stage, some companies have been testing the use of hydrogen in lieu of coal to reduce iron ore. Others, like ArcelorMittal, has been seeking to find productive uses for captured carbon emissions.

Nevertheless, while all engaged steel companies recognise the importance of technological innovation to overcome stalling carbon emissions performance, the technology needed to make a considerable difference to the carbon footprint of steel production is still in the nascent stage. So is the companies’ disclosure on specific investment plans to ensure that emissions are reduced in line with the ambitions of the Paris Agreement.

More efforts needed to reach net-zero carbon emissions from cement and steel

As world’s population grows, the demand for cement and steel is set to follow suit. Decarbonisation of those two largest industrial CO2 emitters would therefore require a much more aggressive actions, if we are to meet the global two-degree goal. Efforts need to focus on scaling up investments in R&D into innovative processes and development of disruptive technologies. Investors can play a crucial part in supporting that transition by actively engaging with the cement and steel companies they invest in.

This blog is part of the climate series, where we present the latest engagement results from the “Top 100 Climate Change Contributors” engagement project.