Strengthening of investor’s fiduciary duty by the new EU Action Plan at the forefront of sustainable finance

European institutional investors can expect a stronger focus on fulfilling their fiduciary duties and there will be more demand of transparency in relation to exercising these duties as part of investment decisions. This direction is now clear from the EU Action Plan and the last week’s high-profile conference on how to move the strategy on sustainable finance going forward. While some of the key outcomes will be already seen in about a year.

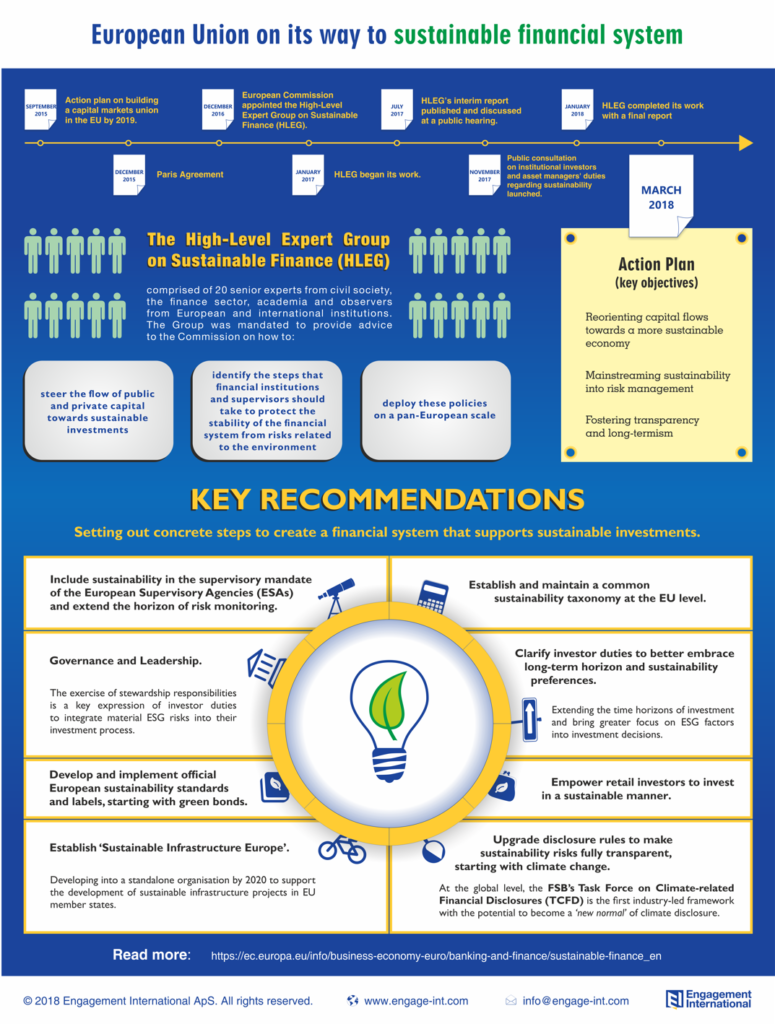

After adopting the rules on non-financial disclosure and strengthening shareholder rights, the EU is now taking a series of major steps towards building a more environmentally and socially sustainable financial system in Europe as part of its work under the broader Capital Markets Union (CMU) Action Plan. Earlier in March, the European Commission launched an Action Plan for legislative initiatives in various policy areas that set up strategy leading through essential changes towards Europe’s sustainable capital markets.

The Commission’s conference opened up a floor for the discussions on the proposed strategy and the follow-up actions. From the investor standpoint, the conversations pointed to the need of reliable ESG data and more clear guidelines for asset managers.

Still, it is difficult to reach a consensus regarding the extent to which the related regulations should be rigid and what could be the best ways to incentivise the market to trigger a change. Financial sector is considered to have a critical role to play in the transition process to a low-carbon, more resource-efficient and sustainable economy. In principle, the speakers at the conference agreed that the costs of not acting would be higher and the expected changes will affect every participant in the financial market.

Discussion on sustainable finance has already been on the agenda for some time with national initiatives in France, UK and Sweden. Clearly, recognising the existing barriers in broader integration of ESG factors, EU is now on its way to transform to a sustainable financial system. However, strong financial regulatory reforms are needed on the European level to bring a systemic change.

The EC’s proposed strategy is the first plan of this kind to steer a financial sector to help reach Europe’s 2030 climate change goals and, not least importantly, the Sustainable Development Goals. The Action Plan builds upon the findings formulated in a comprehensive report by the so-called High-Level Expert Group on Sustainable Finance (HLEG) in early 2018.

The key objectives of the EU strategy indicate the direction by reorienting capital flows towards a more sustainable economy, mainstreaming sustainability into risk management, fostering transparency and long-termism. While the 10 upcoming actions cover all relevant actors in the financial system, some of the proposed changes will have the direct and indirect consequences for institutional investors already in the near future. Having that in mind, the following actions should warrant closer attention by institutional investors:

1. Clarifying institutional investors’ and asset managers’ duties (May 2018)

An important aspect of transformation into sustainable finance will be the strengthening of investors’ and asset managers’ fiduciary duty where it should be clear that sustainability is an important part of it. One of the key areas of the fiduciary duty debate is the extent to which ESG risk assessment should be incorporated into the investment process and how far this can fall under more stricter requirements.

Nevertheless, as a consequence institutional investors and asset managers will be explicitly required to integrate sustainability considerations in the investment decision-making. Moreover, it is expected that investors will publicly inform on how they integrate ESG factors, especially in the consideration of risk and opportunity exposure, and how they are exercising due diligence to avoid, minimise and mitigate negative ESG impacts.

When exercising fiduciary duty, due diligence should be undertaken as part of investment decisions. The process forms the basis for an investor engagement in line with the Shareholder Rights Directive which requires to assess ESG risks and take adequate steps to avoid or mitigate them. Such procedure can be conducted by investors themselves or with a support from external providers such as Engagement International (EI).

In addition, the Action Plan is also endorsing the view that financial industry needs less focus on short-term profit. Instead, awareness and transparency about sustainability risks should increase. So far, financial decisions have been often determined by short-sighted perspectives, whereas the ESG risks, such as climate change, are likely to materialise over a longer period of time.

2. Defining what is “Green” (Q2 2019)

The non-binding and flexible character of EU’s regulations concerning assessment and disclosure of ESG risk factors negatively contributes to lack of consistency in identification and integration of non-financial aspects in investment decisions. To address that gap, EC’s action will focus on enabling investors to identify activities that are sustainable by providing clear and trustworthy common EU definitions on what is ‘green’ and what is not. More granularity is needed on these definitions to understand changes along the transition process to green economy.

As a result, a concrete legislative proposal on the development and governance of an EU classification system for green and sustainable activities is planned to be presented in May 2018. While the first taxonomy on climate mitigation and adaptation activities should come in effect in the second part of 2019. Subsequently, the taxonomy will be developed for the remaining environmental and social activities.

3. Green bond standard (Q2 2019)

In its action plan, the Commission aims to propose EU labels for green products such as Green Bonds and Green Investment Funds to identify sustainable options and climate-friendly investments. A report on an EU green bond standard will be issued by in 2019.

4. Better sustainability benchmarking, rating and research (Q2 2019)

Another EC’s action will be directed at increasing transparency of sustainable indices’ methodologies and harmonising benchmarks comprising low-carbon issuers to reflect alignment with the objectives of the Paris Agreement. A key result of this process will be a report on the design and methodology of the low-carbon benchmark and better assessment of performance of low-carbon funds. Similarly, methodologies of sustainability research and ratings’ assessment/scoring will come under review, including the independence of the services providers. More credibility and quality could be expected out of these efforts.

5. ESG transparency and disclosures (Q2 2019)

Corporate sustainability disclosure is a cornerstone for assessing long-term value and ESG risk exposure. Such disclosure is not fully mandatory today and is characterised by a voluntary approach to a third-party assurance process of relevant ESG metrics. Despite the implementation of the EU Directive on the of Non-Financial Information, the data set needed for investment decisions is still not disclosed at a sufficient level.

To further strengthen sustainability disclosure and accounting rule-making, the Commission takes action via a public consultation process to verify whether public reporting requirements for listed and non-listed companies are designed to fit for purpose.

By the second quarter of 2019, the Commission will also revise the guidelines on non-financial information to provide guidance to companies on disclosure of climate-related information, in line with the Financial Stability Board’s Task Force on Climate-related Financial Disclosure (TCFD) as well as the metrics developed under the new classification system. Such action will help to incorporate climate-related risks into the risk management and investment processes.

Overall, the Action Plan will be implemented in steps taken simultaneously on several levels and addressing a wide range of policy areas. It is not yet possible to foresee the shape of the sustainable finance system. However, the strategy has been generally acknowledged as a positive milestone for supporting sustainable investments. Some fears remain about potential barriers to market development with regulatory complexity or legal uncertainty. As of today, with this concrete roadmap and timelines we can expect that many of the planned actions will become reality relatively soon. While stakeholder consultation could help to balance various interests and positions.

Take a look at the EI’s infographic setting the scene to the European Commissions’ transformation process into sustainable finance.

The full Action Plan can be accessed at the dedicated EU website:

https://ec.europa.eu/info/publications/180308-action-plan-sustainable-growth_en