Long road ahead to net zero for oil and gas majors

The world’s largest oil and gas companies have a main role to play in transition to a net zero emissions economy. Our bi-annual engagement dialogues with 16 of them shows some positive steps forward in terms of climate commitments, target setting and implementation of strategies. However, during the last five years the total direct emissions from the most emitting oil and gas companies increased by 12%.

Since 2016, Engagement International has been conducting systematic engagement dialogues on behalf of institutional investors with the 100 most climate-exposed of all listed companies in the MSCI ACWI IMI Index. Constituents in „Climate Top100” are identified as the companies with the highest Scope 1 and 2 emissions and/or the highest potential emissions from fossil fuel reserves.

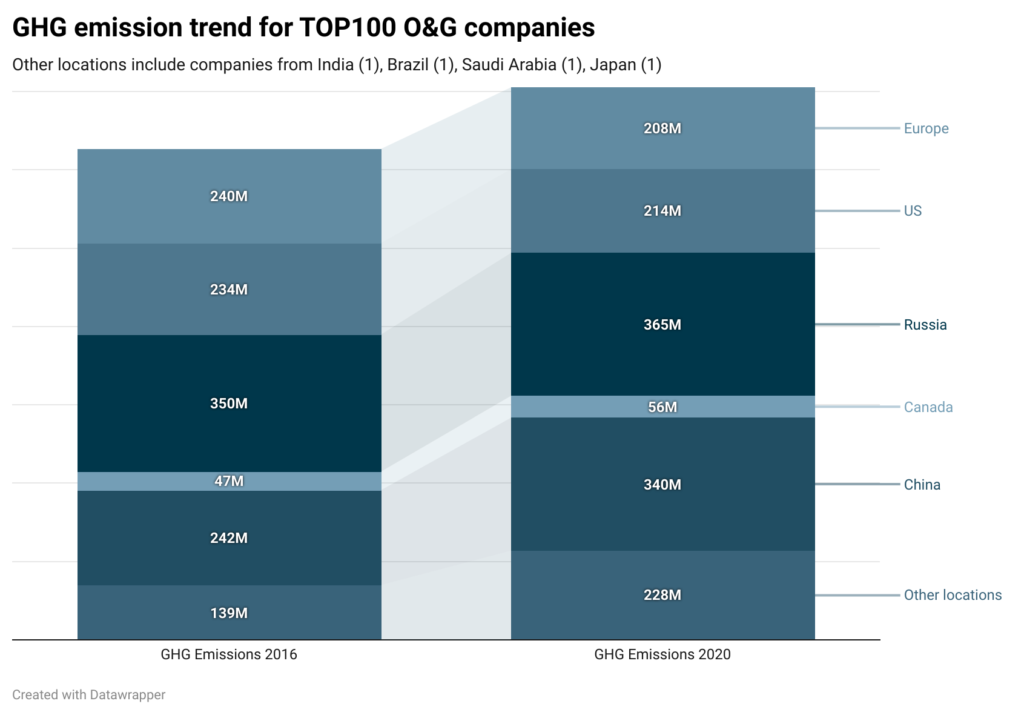

When looking at carbon footprint of 25 oil and gas companies that have been a part of our Climate Top100 universe since 2016, the total absolute Scope 1 and 2 emissions increased by 12% from the baseline to 2020, where we have the latest figures available. However, it covers very different developments in different regions. Most of the increase comes from companies headquartered in China, Russia, Saudi Arabia, Canada and Japan. The absolute record belongs to three Chinese companies and one company from Saudi Arabia. For these companies alone we registered nearly a 200% rise in emissions between 2016 and 2020.

On the contrary, the European companies included in the Climate Top100 universe noted a 13% decrease in their Scope 1+2 emissions from 2016 to 2020. While for the US companies, we registered nearly a 9% decrease in their operational emissions. Brazilian Petrobras and Indian ONGC also slightly reduced their Scope 1 and 2 emissions during the same period.

In general, the emissions have been increasing since 2016 and peaked in 2019. A year later, we saw a general emissions decline across most of the companies, which to some extent can be attributed to the COVID-19 effect. This was also a year when a number of companies announced an ambition to reach net zero GHG emissions by 2050 or sooner.

Scope 3 emissions, especially those related with the use of products sold by oil and gas companies, remain an important focus of our engagement. Although these emissions are many times higher than companies’ operational GHG performance, Scope 3 is not included in this review as emissions data have not been consistently reported by many of the analysed companies during the last five years. In addition, quality and comprehensiveness of reported Scope 3 data remains a challenge.

As reflected in the above overview of companies’ carbon footprint, the European and US companies appear to undertake more systematic efforts to reduce carbon emissions. However, decarbonisation strategies are slightly different across geographies and regions. Also, the depth and pace of a low-carbon transition is rather uneven.

Climate engagement with 10 milestones

We engaged on behalf of our investor clients with about half of oil and gas companies mentioned in the overview, including Integrated Oil & Gas and Exploration & Production companies. The operational emissions from these companies decreased by 2.2% over the five-year period compared to a significant growth in Scope 1 and 2 emissions across all oil and gas companies within the Climate Top100 universe between 2016 and 2020.

In the beginning of 2020, we introduced an enhanced assessment methodology with 10 milestones underpinning our climate engagement with stronger focus on companies’ net zero commitments, associated targets and strategies, and integration of these into business and financial considerations.

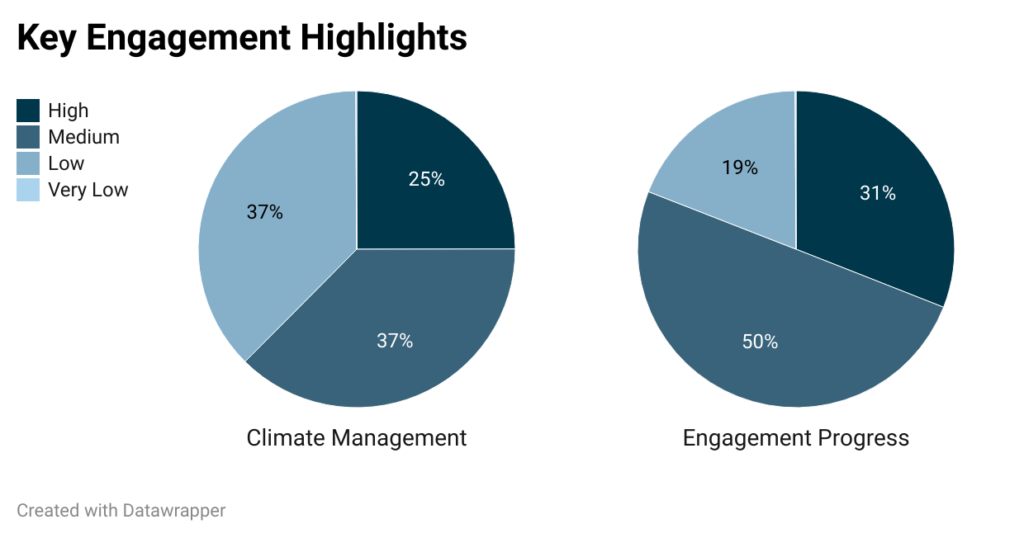

According to our latest engagement round between July and December 2021 with 16 companies, a fourth of the engaged companies shows a general High level of climate management. Nearly 40% is managing climate on a medium level where more decisive steps are still needed to address the remaining gaps. The rest of the companies is not yet on track to align their commitments, targets, strategies with the goals of the Paris Agreement resulting in a Low Climate Management score.

In terms of responsiveness to the engagement goals, recommendations, and dialogue, a third of these companies show Positive Engagement Progress. Half of the companies are also moving forward but progress is moderate and generally slower.

Implementation of net zero ambition

‘Net zero’ has become a buzzword during the recent months. Although many oil and gas companies have been setting net zero goals (with ExxonMobil just recently joining the club), the actual level of ambition depends on the approach to emissions from the fossil fuel products they sell. From that point of view, only relatively few of the companies (31%) have set a comprehensive net zero ambition covering all or majority of their carbon footprint (Scope 1+2 and material Scope 3 emissions).

The prevailing 50% of the engaged companies shows some kind of commitment to net zero or to the goals of the Paris Agreement, but they often refuse to take responsibility for Scope 3 on the argument that these emissions remain out of their control. This means that the large portion of the engaged companies’ total carbon emissions, which lies in Scope 3, is not yet covered by the ambition.

Furthermore, nearly 20% of companies lack clear climate commitments in support of the Paris Agreement. The emission trajectories of these companies are unlikely to demonstrate performance level that is required for a 1.5-degree world.

Our assessment shows that, despite positive signs of more net zero commitments throughout 2020 and 2021, only limited number of companies have stepped up to underpin the ambition with quantitative targets and comprehensive strategies along the way towards 2050.

Considering the main results of our latest bi-annual engagement round reported back to our investor clients in the end of December 2021, the overall Climate Management Level has been improved by five companies. Major developments have been registered regarding commitment to net zero GHG emissions and within the Just Transition milestone. Some instances of change have also been seen in terms of Targets, Decarbonisation Pathways, Business and Financial Integration, and Transparency. However, these have not yet led to more systemic improvements in management and upgrades on the milestone level.

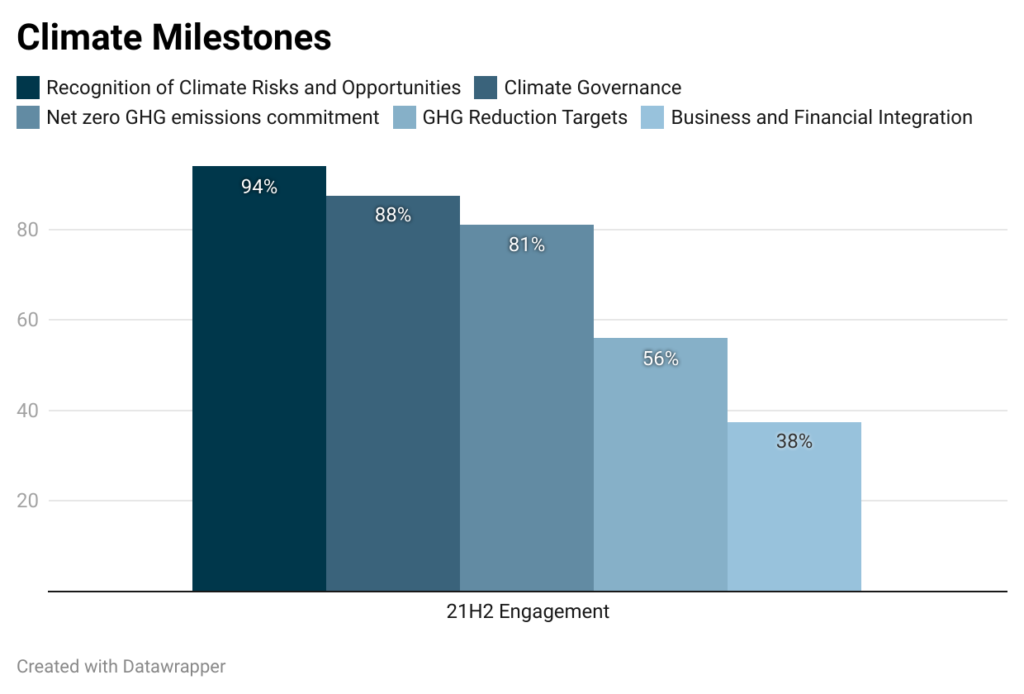

Most of the companies recognise climate as a material issue with consideration of climate-related risks and opportunities to moderate (25% of companies) and high (69%) extent. Likewise, Climate Governance is ensured to at least a moderate degree (56% of all companies). However, the level of board oversight, integration of climate indicators into executive remuneration, and responsible lobbying practices vary across the engaged companies, with the last two being the weakest areas.

Despite climate commitments in place, setting meaningful targets remains a challenge. None of the engaged companies met all the quality criteria for short-, medium-, and long-term targets as of 2021H2. This means that the targets are not yet comprehensive and ambitious enough to drive the carbon emissions down along the Paris-aligned pathway. The companies’ main focus is on targets for the medium term, up to 2030 timeline. To capture the full picture however, it is worth noting that some companies in our oil and gas engagement universe do not even have targets beyond 2025. Boundaries of targets are also shaped by inclusion of business activities on operational basis vs. equity basis. The former leaves emissions from non-operated assets out of control.

Further, most often the companies prefer intensity targets instead of absolute emission reduction. In practical terms, such targets allow to continue or even increase fossil fuel production. As such, the capital remains invested in the core oil and gas businesses for years. Some of the companies argue that they rely on their upstream business pillar to generate cash needed to finance the energy transition with investments in renewable energy and low-carbon solutions. Yet, revenues from these business areas are very low, less than 5% on average. As seen from the chart above, the actual business and financial integration of climate commitments and Capex alignment are very low, as these steps are much more demanding to make.

Decarbonisation Pathways

When it comes to strategies that should support the net zero commitments and associated targets, climate roadmaps beyond 2030 are broadly missing. Acceleration of carbon emission reduction efforts post 2030 is likely to happen due to expected changes in consumer behaviour. However, for the long-term plans, especially the period between 2040 and 2050, investors need further clarification on how companies plan to balance their emissions to reach ‘net’ zero. Here, uncertainties around the technology readiness, feasibility, economics and use of natural carbon offsets are dominating.

The overall climate strategies implemented by the oil and gas industry across the board are diverse. Some corporations aim to reshape their businesses to transform to the integrated energy companies by building a portfolio of renewables and other low-carbon energy solutions. BP, TotalEnergies, Eni and Shell can be examples of such strategies. While on the other end of the scale, there are companies that strategically strive to remain one of the low carbon – low cost fossil fuel supplier in the future (e.g. ConocoPhillips, Occidental Petroleum, Chevron).

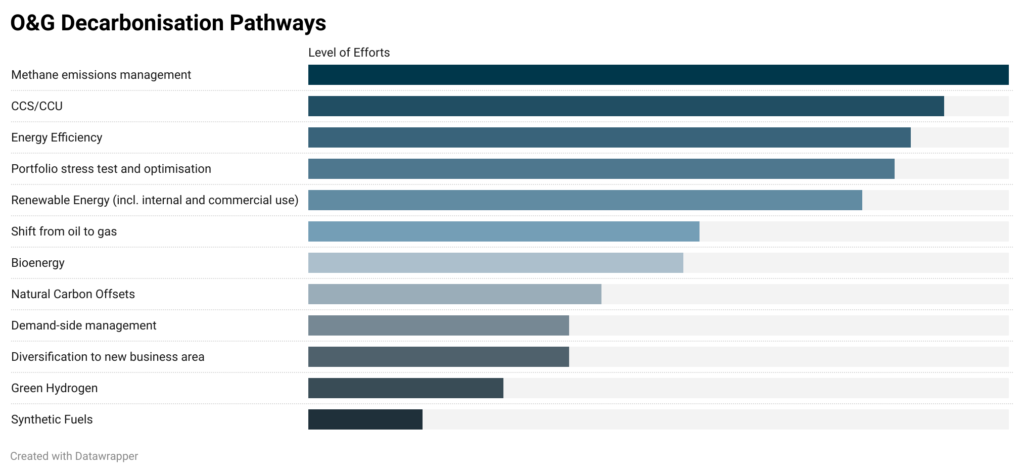

Regardless of the strategy that underpins a business model, our engagement indicates that most efforts are concentrated on relatively few decarbonisation pathways which are intended to make oil and gas operations more efficient. These are methane emissions management, carbon capture, storage and utilisation, energy efficiency, and portfolio optimisation. All these measures are associated with reducing emissions from current oil and gas production, allowing to continue the operations rather than shifting to alternative low-carbon opportunities and new business areas. Renewable energy is primarily used to power operations, thus reduce Scope 2 emissions.

Exploration and production in light of carbon neutrality

Growing pressure for more aggressive CO2 emission reduction raises questions about oil and gas exploration and production plans and how these align with a net zero ambition. From that perspective however, the statistics are not satisfactory. Still, for many of the engaged oil and gas companies, climate action is driven by the overall strategy to remain the most efficient oil and gas producer in the decades to come. There is a general lack of recognition of the need to stop exploration and curtail production levels, as emphasised by the IEA Net Zero by 2050 report.

Between 2016 and 2020, nine companies out of 13, for which we analysed historical data, increased production level. The trend seems to continue. The overall industry exploration spend and appraisal drilling started to bounce back in 2021, after a significant decrease in 2020 when exploration drilling hit the lowest level in the last 10 years.

The industry majors alone contributed to 40% of new oil and gas volumes discovered globally last year. Equinor, TotalEnergies, ExxonMobil, Eni and Shell are just a few examples from our focus list leading exploration activities throughout 2021. The companies have been also expanding their presence moving to the new regions like Eni’s Baleine discovery, a first exploration well drilled by the company in the Ivory Coast, or Shell’s significant discovery of light oil in Namibia, being a start of the first ever hydrocarbons exploration and production in this country. The Namibian oilfield is expected to be in operation by 2026.

As more oil and gas discoveries come to light, the impacts of companies’ net zero pledges on production levels are rather unlikely in the medium time horizon. As of 2021H2, only five of the engaged companies acknowledged declining production (at least) from oil in the mid-term, but the level of detail provided behind these considerations varies among the companies. Only two companies, to some extent, committed to production decline through 2030. BP plans to reduce its own oil and gas production volume by 20% until 2025 and by 40% until 2030, and not to conduct exploration activities in new countries. Whereas Shell expects a gradual reduction of 1–2% per year in oil production up to 2030 and not to conduct new frontier greenfield exploration but only after 2025.

At the same time, the companies are shifting their portfolios to natural gas with efforts to decarbonise it through CCS and hydrogen solutions — both still uncertain technologies. Likewise, exploration efforts are also redirected to support this strategy. Reportedly, natural gas accounted for around 60% of all discoveries in 2021. As such, the role of gas globally will grow over time leading to increasing production that would be inconsistent with limiting global warming to 1.5°C.

Time for more radical action

Considering the forward-looking projections, it appears that major oil and gas companies’ targets deviate from a net zero trajectory in the 2030-time horizon. However, there are a few companies that have progressed since 2016 and now align — or are close to align — with the trajectory in 2050. As confirmed by the most recent assessment from the Transition Pathway Initiative, Eni, TotalEnergies and Occidental Petroleum are expected to reach the 1.5-degree benchmark in 2050, if they deliver on their carbon reduction targets. Shell is close to meeting the Below Two Degrees benchmark.

Yet, the overall industry emission reduction level is far from being aligned with the net zero trajectory. Our engagement shows that most of the major oil and gas companies still largely stay behind investors’ expectations with low- to medium-level climate management and low performance. The real-world impacts are not likely to be seen any time soon. Moreover, according to our preliminary engagement with a broader range of oil and gas laggards in the expanded Climate Top1000+ universe, the picture appears to be even worse. This trend needs to be reversed, if the overarching goal of net zero GHG emissions for the world is to be reached by 2050.