How to engage on climate Net Zero

Since the Paris Agreement was signed in 2016, Engagement International has been engaging on behalf of institutional investor clients with the 100 listed companies that are most exposed to climate change, when it comes to the highest scope 1 and 2 emissions or potential emissions from fossil fuel reserves.

Our engagement dialogues are structured around two annual meetings, face-to-face, by video calls or e-mail dialogue. It means that our investor clients through now more than 10 engagement meetings have continuously influenced portfolio companies like Royal Dutch Shell, BHP and TEPCO to decarbonize and align with the Paris Agreement. It creates influence and a solid overview of which portfolio companies are on the right climate track and which are not.

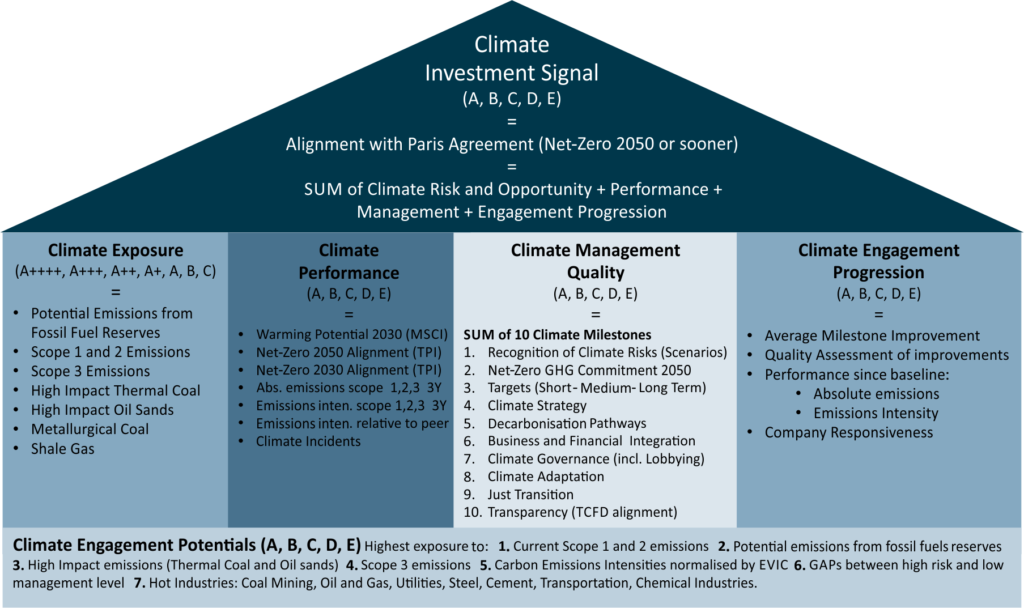

Engagement is also one of the key elements in the new Net Zero frameworks and alliances for asset owners, asset managers, banks, insurance companies etc., announced as the best way to create “real world changes”. Due to this, we have now updated our engagement methodology including six engagement ratings and 10 milestones to be aligned with the requirements and recommendations from the Net Zero frameworks that are now setting the global standard.

The latest revision of our engagement methodology also includes new and advanced Climate VaR (Value-at-Risk) models and data points from MSCI ESG Research that we have collaborated closely with since 2014. Other important data sources used are TPI, TCFD, CDP and Science Based Targets.

About half of the Climate Top100 companies we are engaging with are overlapping with the companies in the Climate Action 100+ (that we support as an active participant), while about 50 companies are outside this framework. Hence, our engagement can supplement the climate engagements institutional investors are already doing themselves, through their asset managers or through Climate Action 100+.

First step of the engagement process is the investor client’s free and flexible selection of the engagement cases they want to participate in together with other investor clients. Engagement International can support with an assessment of the listed equity and corporate bond portfolio, to identify the most relevant engagement cases with the highest Engagement Potential.

Climate has become the most important ESG issue for most institutional investors. And engagement dialogue is one of the main elements to become Net Zero aligned with the Paris Agreement.

Flexible selection of engagement cases

The result depends on the individual investor clients’ climate policy and set-up. However, as a point of departure, we consider the companies with the highest scope 1 and 2 emissions and potential emissions from fossil fuel reserves as associated with the highest Engagement Potential. These are first and foremost found in the industries of mining, oil and gas, electric utilities, cement and steel.

Inclusion of the highest scope 3 emissions leads to potential engagement cases in the airline, automobile and marine industries. Other “hot industries” to focus on could be chemicals, other industries, real estate, and banks.

As a guidance for selecting companies to engage or divest, we provide our investor clients with a climate risk and opportunity exposure rating. Primarily, it depends on the relative amount of high-impact thermal coal and oil sand activities that can be associated to a certain portfolio company. A company with more than 90 percent of revenues from thermal coal or oil sands would be assessed to the highest Climate Risk score of A++++. The risk is that it becomes a stranded asset with low or no financial value or a loser in the competition, due to bad standing and political regulations as carbon taxes.

Most institutional investors divest from companies with a high share of revenue or capacity tied to thermal coal and oil sands, as they will most likely never be aligned with the Net Zero goal. We will typically flag these companies as not aligned. However, as long as they are identified in our client’s portfolios and they want us to continue our dialogue with the companies, we keep on trying to push them in the right direction.

10 revised milestones

Step two in the engagement process is to invite the selected portfolio companies to an engagement meeting. The invitation will always be accompanied by our recommended meeting agenda. Here we suggest to discussing the gaps in the engaged company’s climate management, we have identified after a comprehensive assessment of the company. About 80 percent of the companies, we invite, accept the invitation and meeting agenda.

The semi-annual engagement meetings are arranged with most relevant company representatives which can be investor relation managers, sustainability experts, general managers, or board members.

After the meeting, a Company Engagement Report would be revised, containing a description of the dialogue, our recommendations for improvements and the updated engagement ratings.

The Climate Performance rating contains several backward- and forward-looking key indicators. The historical are 1) The reduction of carbon emissions in absolute tonnes, scope 1 and 2 and if relevant, scope 3. 2) The reduction of carbon intensities normalized by production and investments (EVIC) 3) The carbon intensity relative to peers and 4) Climate-related controversies. The emission reductions should be compared with science-based targets, if possible.

However, when it comes to climate, the historic development is less important than the forward- looking perspective. Hence, the Climate Performance rating also depends on whether 1) A company’s performance and reduction targets are aligned with the Net Zero goal in 2030 and 2050, according to TPI assessments in three scenarios, the Paris Pledge, the two-degree goal and the less than two- degree goal. 2) A company’s performance is aligned with these temperature criteria in 2030, according to MSCI ESG Research’s Warming Potential model.

However, to trust that a certain company will actually reduce its carbon emissions according to its own and science-based targets, it has to show a solid climate management preparedness. How solid, is measured against 10 climate management milestones, which we recently have revised to be aligned with the requirements and recommendations in the Net Zero frameworks. The nuances and details can differ. However, our revised climate milestones that constitute the Climate Management Level are the following:

1. Recognition of Climate Risks (including Scenarios)

2. Net-Zero GHG Commitment 2050 or sooner

3. Carbon Reduction Targets (Short- medium- and long term)

4. Climate Strategy

5. Decarbonization Pathways

6. Business and Financial Integration (including Capex)

7. Climate Governance (including Lobbying)

8. Climate Adaptation

9. Just Transition

10. Transparency (TCFD alignment)

The Climate Management Level rating shows the quality level of a company’s preparedness to address climate risks and align with the Net Zero goal.

The Engagement Progression rating shows the responsiveness to engagement dialogue and how fast the company is improving its climate management and performance.

Finally, the Climate Investment Signal integrates all climate ratings in an overall score showing to which extent the company is evaluated as aligned, aligning, or not aligned with the Paris Agreement in terms of the 1.5 degree and Net-Zero goal.

All ratings, assessments, data points, dialogue descriptions and recommendations for improvements updated in the Company Engagement Report are sent to the engaged company for review, before the report is made available for investor clients through Engagement International’s web platform. Here clients have also access to updated Climate Portfolio Reports and Climate Investment Signal overview in an Excel format, showing main engagement results for all relevant engagement cases.

Investor benefits

Climate has become the most important ESG issue for most institutional investors. And engagement dialogue is one of the main elements to become Net Zero aligned with the Paris Agreement.

By participating in Engagement International’s Climate Engagement cases, asset owners and asset managers can obtain the following benefits:

- An assessment of the listed equity and bond portfolio to flag the companies with the highest Engagement Potential.

- A flexible selection of which and how many engagement cases to attend – including more than 50 companies with very high climate exposure, not covered by Climate Action 100+.

- Participation in independent semi-annual engagement dialogues, as Engagement International does not have any investments or other financial interests in the engaged companies.

- Engagement ratings and milestone assessments of Paris Agreement alignment, as recommended by the Net Zero frameworks.

- Comprehensive company engagement reports covering advanced TPI and MSCI ESG Research climate data and assessments, industry-specific pathways, engagement dialogues, recommendations for improvements and documented engagement results since 2016.