Backing utilities’ net-zero ambition with intermediary targets

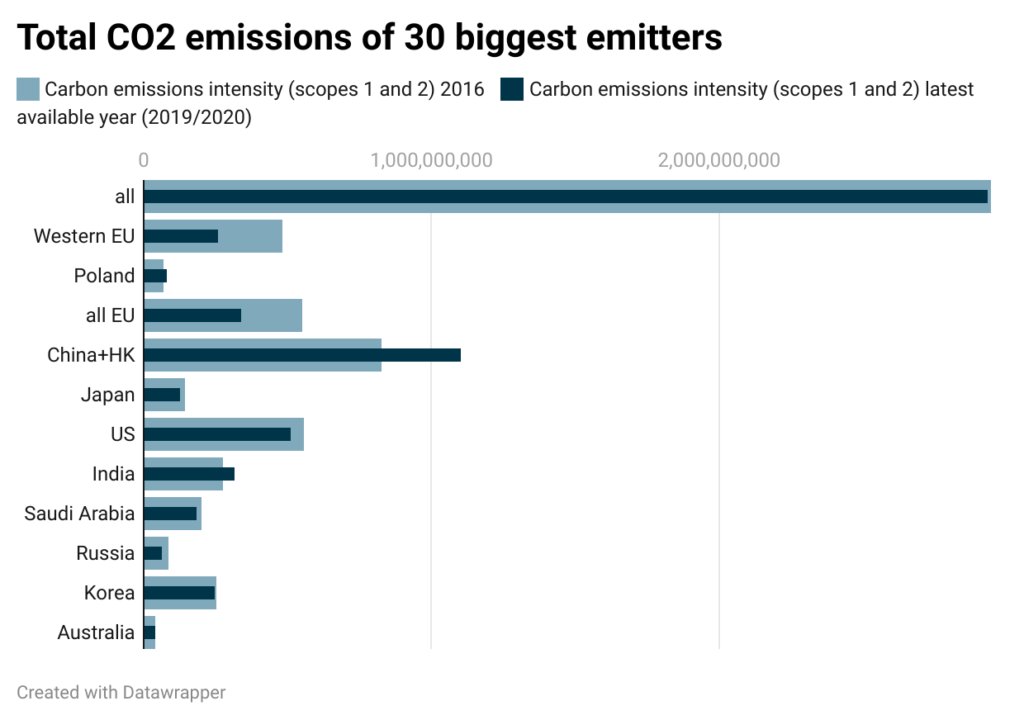

Electric utilities are among the main contributors to the global GHG emissions due to their reliance on heavy use of fossil fuels. Consequently, the strength of their commitment to achieving net-zero in accordance with the Paris Agreement, as well as credibility of their decarbonisation strategies are of vital interest to the global community and investors. However, in general the last five years brought no significant change in emissions from the top contributors to the climate change in this sector. Out of 30 biggest emitters, 12 (40%) have increased their scope 1 and 2 emissions since signing of the Paris Agreement.

Climate Top 100 engagement

We chose the 100 top emitters of all listed companies in the MSCI ACWI IMI Index, based on their scope 1 and 2 emissions or their potential emissions from fossil fuel reserves. 31 out of the 100 are utility companies, and almost a third of them is held by our clients in their portfolios. As part of our Climate Top100 engagement, we have been conducting dialogues with the companies twice a year on behalf of our institutional investor clients since 2016. We structured the assessment into 10 milestones to separately measure the engagement progress in each of the crucial areas. Between 2016 and the latest available emissions data, 12 of them increased their GHG emissions, but 18 – limited them. Data for one company was incomplete. In the beginning of 2020, we adapted our climate engagement assessment methodology to increased and new investors’ requirements. Our assessment criteria put a stronger emphasis on net-zero commitments, intermediate targets and decarbonisation plans. We also look deeper into how the companies integrate the targets into their financial planning, governance and overall strategy, to ascertain that climate adaptation and mitigation are fully integrated into their management and operations.

2016-2020 emissions by regions

Utility companies are responsible for 36% of the direct carbon emissions of the MSCI ACWI Investable Market Index (IMI). Absolute scope 1 and 2 CO2 emissions of the 31 utility companies included in the Climate Top 100 were about the same in 2020 as in 2016, based on MSCI ESG Research data. Generally speaking, emissions fall faster in more technologically advanced countries. However, we observed significant differences in emissions trends not only between regions, but also within them.

Seven companies headquartered in the EU reached a decline in emissions of around 39% between 2016 and 2020, the highest among regions in our ranking. Enel proved the leader in emission reduction, achieving a result over 50%. One Northern-European company’s emissions grew by more than 100% due to a takeover of a competitor which owns many coal plants. A sharp divide is visible between the companies from Western EU (Germany, France, Italy), and the Polish ones; the former achieved an impressive 46% decrease, while the ones located in Poland produced a 17% increase in emissions, which is more than Indian companies (15%). While some of the divergence could be attributed to historical development of the sector, national energy policies and governments’ stance towards climate change need to be regarded as equally important factors. Some European countries accelerate closures of coal plants, others – support the coal industry. All but one European utility company are partially held by the state. Therefore, national policy’s influence on their decisions and strategies is not to be underestimated. In contract, none of the US companies on the Climate Top 100 list was. Globally, 17 out of the 31 companies are state-held.

The United States are home to even greater contrasts than the EU: one of eight American companies increased its emissions by over 525% within the 2016-2020 period due to organisational changes, gaining the dishonourable first place on the list. The US companies collectively limited their emissions by 9%. Our engagement dialogues indicate that the American companies are strongly influenced by climate change strategies of the states in which they operate. Some, e.g., California, require utilities to comply with emission reduction targets. Other states prioritise low consumer prices.

Companies located in China and Hong Kong increased their emissions by approximately 34% – the highest regional value. Investors need to remember that this not at odds with China’s own climate strategy, which proposes emissions peak by 2030 and net-zero by 2060. Japan, on the other hand, reached a moderate drop of 14%.

Intermediate targets to net-zero

Much of the criticism of net-zero commitments focuses on their remoteness in time: with more than quarter of a century to hit the target, it may be too easy for the emitters to make promises without a serious plan how to put them into effect. In our Climate Top 100 engagement, we pay special attention to the quality of net-zero commitments the companies make. We look at the emissions’ scopes they commit to limit to zero, the deadlines they set and how binding they consider the commitment to be. Targets are of just as much importance, because their absence or poor quality undermine credibility of net-zero commitment. Companies should support their net-zero pledge with short-, mid-, and long-term emissions reduction targets, which need to be realistic, science-based and externally verified. One of the frameworks we use for this purpose is Science-based Targets initiative (SBTi).

SBTi is a collaboration initiative gathering companies which intend to set and publicly announce net-zero commitment and intermediary targets, in accordance with the current state of science. The science-based targets are aligned with what science deems necessary to meet the goals of the Paris Agreement, and possible considering the technologies available. SBTi develops sectoral methodologies to target-setting and certifies the process. Guidance for the utilities sector is available.

Only six utilities companies from our Climate Top 100 joined the SBTi, and five made a net-zero commitment, which suggests that the biggest emitters still have work to do when it comes to sketching their roadmap towards net-zero. Some of them may be reluctant to go through the verification process, but it is equally possible that they have not yet created a detailed enough strategy. Throughout the engagement, we have seen that companies’ strategies gradually become more precise and concrete. Considering that 1.5oC pathway may soon become the only one to be accepted by SBTi and investors, utilities have much to do adapting their strategies and setting science-based, realistic emission reduction targets.

We rated most of the engaged utilities’ net-zero commitment as high, which means that they covered appropriate emission scopes within the timeframe indicated by the Paris Agreement (2050), among other requirements. In the last two years, we observed that companies appreciate the value of having their targets verified as science-based: several set and updated their science-based targets in 2020 and 2021. Several others communicated during engagement dialogue that they were in the process of having their targets verified.

European companies are more open than their American counterparts to committing publicly to net-zero by 2050, and to disclosing intermediary targets. The reluctance to making the commitment and formulating (or disclosing) details of emission reduction plans appears not to be directly linked to emissions reduction performance of a company. The companies which decline to do so often explain their non-committal by uncertain viability of innovative technologies necessary for achieving net-zero, and by a changing legal environment. They may also be more apprehensive about legal action being taken by shareholders over what they may see as untenable targets.

Although the SBTi standard seems to be more accepted by the EU companies, US companies also begin to recognise the advantage it gives them in terms of retaining and attracting investors. One may expect that this trend will continue, with a proxy advisor having recently recommended against re-election of board of a Finnish utility company based on its climate strategy, especially lack of science-based emissions reduction targets.

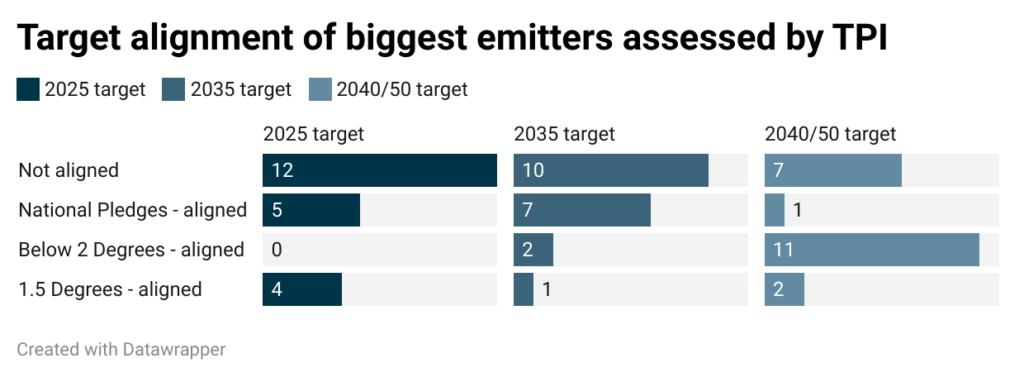

Another benchmark we consider is the Transition Pathway Initiative (TPI). The TPI assesses companies’ preparedness for carbon transition, creating a benchmark with four pathways: not aligned, aligned with National Pledges, aligned with Below-2oC and aligned with 1.5oC pathway. Out of the 31 Climate Top 100 utility companies, 22 were assessed by the TPI. Out of the 22, only four were assessed as aligned with 1.5oC pathway in 2025. For 2040/2050, the number of 1.5oC-aligned companies falls to two: one is from the US and one is from Germany, and neither of them is aligned for 2025. 12 companies are assessed as not aligned for 2025, and seven remain so for 2040/2050, with other moving towards National Pledges or Below-2oC by this time. Each TPI assessment finds companies improve their strategies and alignment, and we observe progress of most companies we engage with as well. They make a visible effort to forge a feasible emissions reduction strategy based on science and existing or expected technologies. However, the results of 31 emitters taken together are still far from what is needed for setting the sector on the 1.5oC pathway to net-zero by 2050. Investors’ requirements of the sector keep growing – as evidenced by e.g., the report “Global sector strategies: Investor interventions to accelerate net-zero electric utilities” produced by Institutional Investors Group on Climate Change (IIGCC) in cooperation with Climate Action 100+. There are companies which will successfully meet these stringent demands, having already formulated appropriate strategies. Others will need continued pressure to act. Direct engagement with the companies is necessary to translate the investor pressure into results, and to channel investment to the entities that truly contribute to keeping the global warming at 1.5oC.