10 key points in the new Net Zero Investor Frameworks

Climate change has become the most important ESG issue for institutional investors, corporations, cities, and nations. And “Net Zero” is the new narrative to describe the ambition of being aligned with the Paris Agreement or 1.5-degree goal. All around the world, thousands of organizations are committing themselves to achieve the state of “Net Zero in 2050 or sooner”, where they achieve an overall balance between emissions produced and emissions taken out of the atmosphere.

To reach this state, an increasing number of institutional investors are following one of three net zero investor frameworks, published within the latest months:

- Net Zero Investment Framework: Launched March 2021 by the Paris Aligned Investment Initiative (PAII), the four regional investor network IIGCC, Ceres, AIGCC, IGCC and supported by +100 Asset Owners and Asset Managers.

- Inaugural 2025 Target Setting Protocol: Launched January 2021 and by the UNEP FI, PRI, the UN-Convened Net-Zero Asset Owner Alliance, supported by +30 Asset Owners.

- Net Zero Asset Managers Initiative: Launched December 2020 by the PRI, CDP and the four regional investor network IIGCC, Ceres, AIGCC, IGCC and the Net Zero Asset Manager Alliance, supported by +70 asset managers.

Although there are different nuances in the details of the three approaches to Net Zero, the goals, strategies, and key points are very similar. Hence, it seems like these core elements of the frameworks are now defining what is expected from climate responsible institutional investors.

With the risk of ignoring the minor differences between the three investor frameworks, we have tried to extract 10 overlapping key points in terms of what institutional investor should do to become Net Zero and aligned with the Paris Agreement and 1.5-degree goal. Some of these are described in detail in the individual frameworks and less in others. There are also differences between the recommendations for different asset classes. Here focus is on listed equities and corporate bonds.

However, here are the 10 key expectations to institutional investors who want to be aligned with the Paris Agreement and 1.5-degree goal, expressed as “Net Zero”:

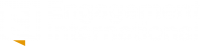

1. Commitment: The board or the investment committee should commit to transitioning investment portfolios to net-zero GHG emissions by 2050 or sooner, consistent with the Paris Agreement and a maximum temperature rise of 1.5°C.

2. Governance: The Net Zero goal, as well as implementation of strategies and framework recommendations should cover the investor organisation as a whole, all asset classes and portfolios, and the assessment of and approach to all assets as individual bonds, equities and real estates.

3. Prioritisation: When it comes to asset classes, the institutional investor should prioritise in the following order: listed equities, listed bonds, real estate, sovereign bonds, private equity, infrastructure, mortgage, and finally unlisted corporate debt. Sectors should be prioritised by first focusing on the “hot industries”: Mining, Oil & Gas, Electric Utilities, Steel, Cement, Pulp & Paper, Chemicals, Autos, Airlines, Shipping, Other Industrials – and later Real Estate and Banks.

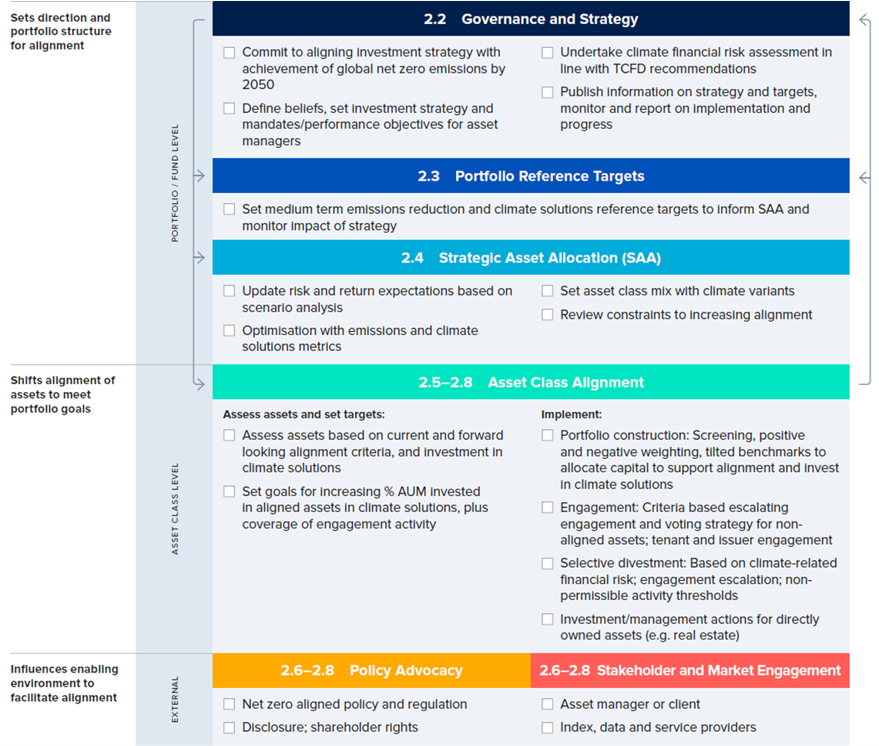

4. Targets: Science-based carbon emission reduction targets should first be set for scope 1 and 2 and for material scope 3 over time. The short-, medium- and long-term targets should be expressed in GHG in absolute tonnes, and carbon intensities normalised by EVIC, production or revenue. Adjusted five-year targets are encouraged. Medium targets for 2030 should be consistent with a fair share of the 50% global reduction in CO2, identified as a requirement in the IPCC special report on global warming of 1.5°C.

5. Pathways: Two main roads to Net Zero should be used – 1) Decarbonisation of investment portfolios through science- and sector-based decarbonisation pathways, in terms of emissions, technologies and investment trajectories, and 2) Investment in climate solutions as renewables (not at least in emerging markets) green hydrogen, green buildings, sustainable forest, sustainable agriculture etc.

6. Engagement: Engagement with portfolio companies is recommended, not at least because it is the best way to create real economy change. Engagement can be conducted directly by asset owners and managers, through Climate Action 100+ or by specialised providers of collaborative engagement. Divestment should primarily be used as an escalation tactic, if engagement does not lead to positive results, but can also be used as a consequence of climate financial risk assessment or if a business activity like thermal coal or oil sands is not considered as a credible pathway towards the Net Zero goal. Investors are also encouraged to engage with asset managers, credit rating agencies, stock exchanges, proxy advisers etc., to publish position papers and to contribute to policy advocacy and market engagement.

7. Corporate Assessment: Portfolio companies should be assessed against 10 milestones: 1) Commitment to Net Zero 2050 or sooner 2) Science-based short- medium- and long-term emission reduction targets (absolute and intensities scope 1 and 2 first, and 3 when possible and relevant) 3) Emission performance relative to targets 4) Disclosure of scope 1, 2 and material scope 3 emissions, 5) Decarbonisation strategy and pathways 6) Capex consistent with net zero 2050 7) Lobbying policy and alignment 8) Governance in terms of board oversight and climate-related executive remuneration 9) Just transition not at least regarding workers and communities and 10) Reporting on climate risk and accounts aligned with the TCFD recommendations (including risks and scenarios)

8. Investor Portfolio Assessment: Listed equity and corporate bond portfolios should be assessed by five criteria: 1) Carbon Emission reduction, scope 1 and 2 first, and over time material scope 3, in absolute tonnes of CO2e 2) Carbon Emission reduction, scope 1 and 2 first, and over time material scope 3, intensities normalised by EVIC, production or revenue 3) AUM percentage of revenues or capex invested in climate solutions 4) Percentage coverage of portfolio companies that are aligned with the corporate net-zero expectations 5) Engagements with high emitting portfolio companies not yet net-zero aligned and covering 65–70% of investor-financed emissions.

9. Carbon offsets: Where these are necessary, due to lack of technologically and/or financially viable alternatives to eliminate emissions, the investment should be in long-term carbon removal.

10. Annual reporting in line with TCFD recommendations on efforts, progress, impacts, and risks in different scenarios.